b&o tax credit

Business Occupation BO Tax. BO Tax 2021 Annual Return.

B O Tax Credit Program Puyallup Main Street Association

Find Tax Credits Location Phone Number and Service Offerings.

. The state BO tax is a gross receipts tax. BO Tax 2022 Quarterly Return. Use External Credits when one of your business activities.

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount. Your business does not owe general business and occupation BO tax if you had annual income of less than 100000. Tax and sewer payments checks only.

You can make the donation by sending a check to the following address. To pay your sewer bill on line click here. Small business tax relief based on income of business.

45 Knightsbridge Rd Ste 22 Piscataway NJ 08854 Service. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. Make a pledge of as little as 1000 to Puyallup Main Street Association beginning January 10 to March 30 2022 pay the pledge to PMSA by November 15th and 75 of your pledge will be.

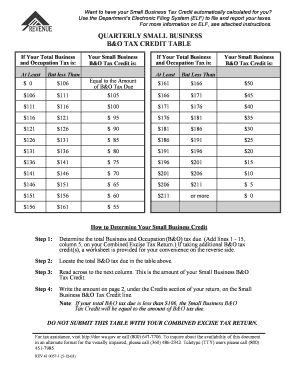

This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. But you still must file and report that to the City even. Puyallup Main Street Association.

Washington unlike many other states does not have. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. An ordinance of the Council of the City of Fairmont enacted in part pursuant to the provisions of West Virginia Code Section 8-1-5a Municipal.

No cash may be dropped off at any time in a box located at the front door of Town Hall. In 2022 when you go to pay your BO. You are eligible for a property tax deduction or a property tax credit only if.

It is measured on the value of products gross proceeds of sale or gross income of the business. Get information about BO tax credits. B O Tax.

Taxfilekentwagov Most businesses that. Tax Credits Phone Number. Use Internal Credits when both your business activities manufacturing and retail sales for example occurred within Seattle.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Main Street Tax Credit Incentive Program Wenatchee Downtown Association

Tax Exempts And Washington S Business And Occupation Tax

Allocate Your B O Tax Historic Downtown Kennewick Partnership

Ghj Changes To Gross Receipts Taxes Washington And Oregon Updates For 2020

Wheeling Finance Committee Approves B O Tax Credit Lede News

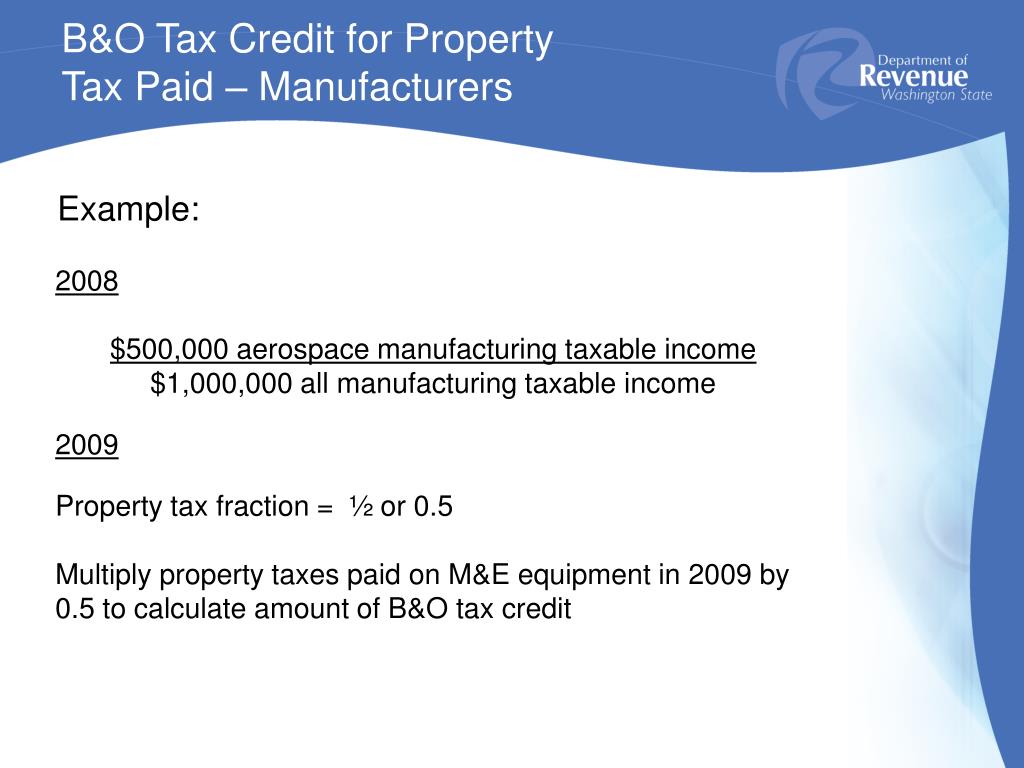

Ppt Washington S Aerospace Tax Incentives Powerpoint Presentation Free Download Id 5764876

Business Occupation Tax Bainbridge Island Wa Official Website

Fillable Online Quarterly Small Business B O Tax Credit Table Fax Email Print Pdffiller

Projects Programs Kent Downtown Partnership

Analyzing The New Oregon Corporate Activity Tax

Flexible Incentives Tacoma Incentives City B O Tax Credit For New Full Time Employment Policy Commons

Business Occupation Tax Bainbridge Island Wa Official Website

Gig Harbor Downtown Waterfront Alliance Your B O Taxes Can Stay Right Here In Gig Harbor Through The Washington Main Street B O Tax Credit Program Good For Your Business Good For The

Wheeling Finance Committee Approves B O Tax Credit Lede News

Main Street Tax Incentive Program Downtown Bellingham

Washington State Tax Updates Withum

Business Occupation Tax Bainbridge Island Wa Official Website

Washington S Aerospace Tax Incentives Kristine Rompa Gary Grossmann Afa 2010 Summit Ppt Download